Edmonton, Alberta – (May 23, 2024) – Yorkton Equity Group Inc. (TSXV YEG) (“Yorkton” or the “Company”) is very pleased to announce its financial results for the first quarter ended March 31st, 2024.

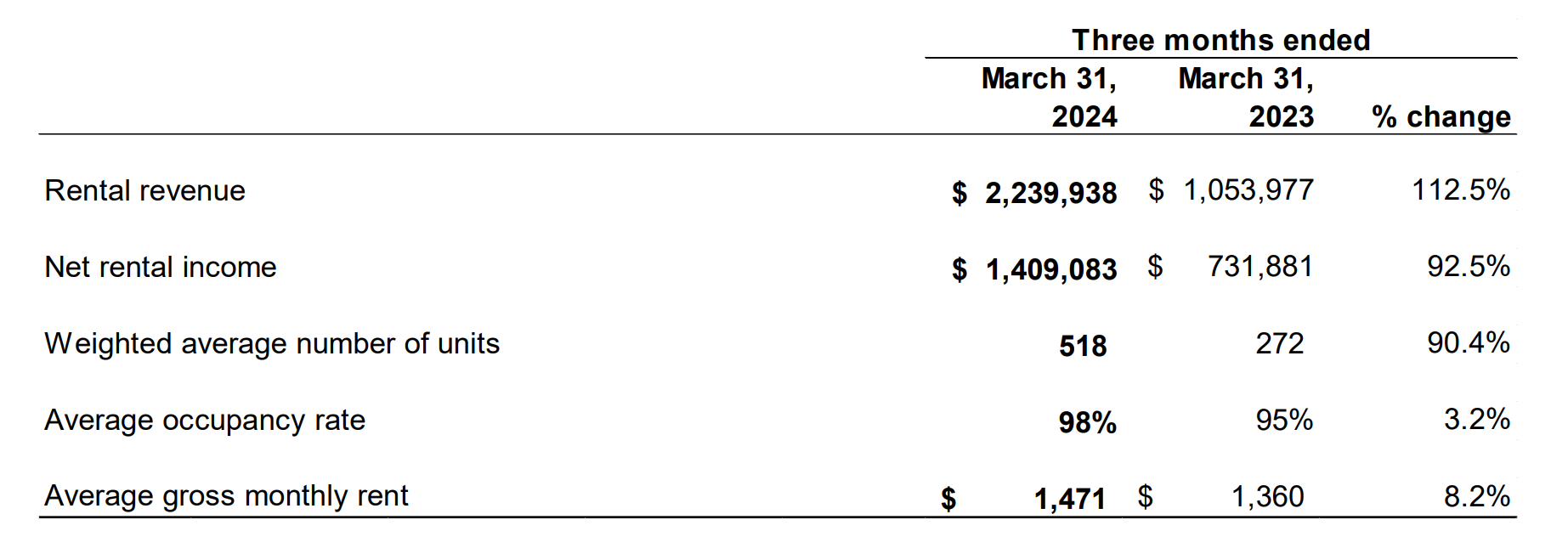

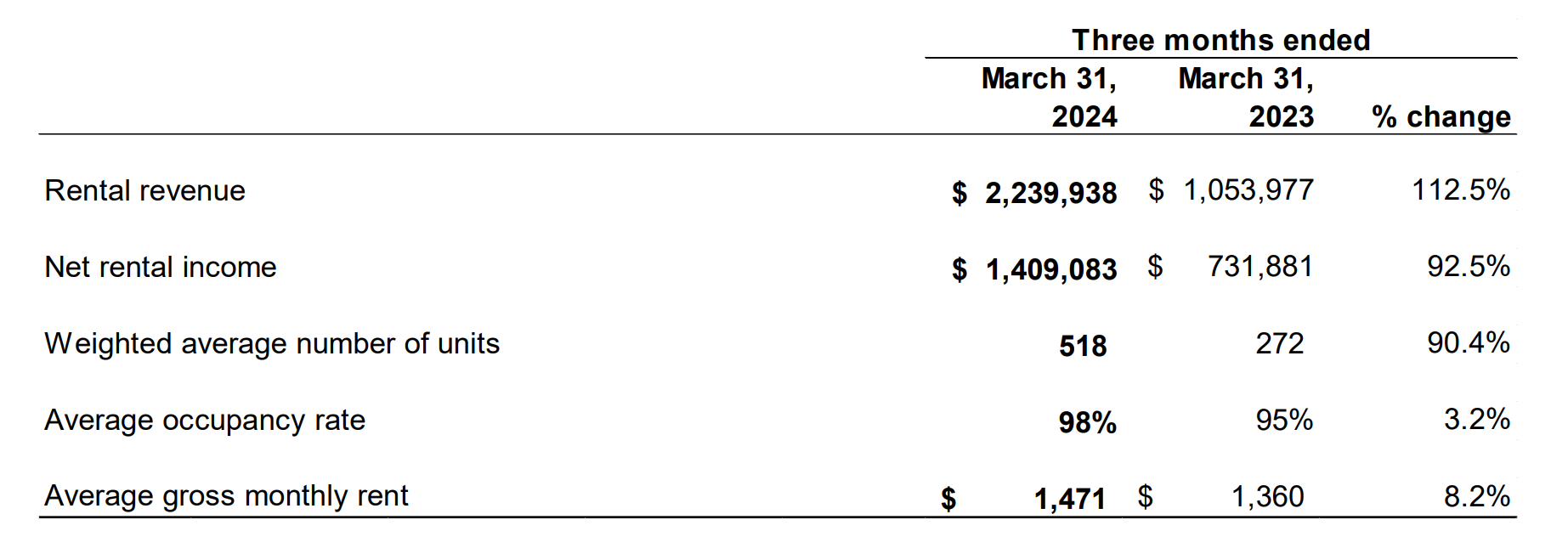

Mr. Ben Lui, President and CEO of Yorkton, is very excited to report, “Yorkton’s residential rental revenue increased by 113% to $2.2 million and residential net rental income increased by 93% to $1.4 million in Q1 2024 as compared to Q1 2023. These increases are due to strong organic growth together with our strategic investment property acquisitions in 2023. Yorkton is well positioned to continue to capitalize on the growth in Alberta’s multi-family rental market, which has recently been driven by factors such as a rapidly expanding population from interprovincial and international immigration, a resilient economy, a robust labor market, affordable housing costs and fewer regulations around rent controls compared to other markets in Canada.”

Q1 2024 Financial Highlights

- Total rental revenue increased by $1,147,023 or 97.7% to $2,320,815. This was composed of an increase in rental revenue from the residential investment properties of $1,185,961 or 112.5% to $2,239,938 and a decrease in rental revenue from the commercial investment property of $38,938 or 32.5% to $80,877.

- Net rental income increased by $618,065 or 74.9% to $1,443,123.

- Overall there was net income and comprehensive income of $1,038 in Q1 2024 as compared to $573 in Q1 2023.

- As at March 31st, 2024, Yorkton holds 518 residential rental units and 28,036 sq.ft. of commercial space with a total portfolio value of $126,702,120, which grew by 31.2% as compared to March 31st, 2023.

Highlights of the residential rental portfolio for the three months ended March 31st, 2024 are:

About Yorkton

Yorkton Equity Group Inc. is a growth-oriented real estate investment company committed to providing shareholders with growing assets through accretive acquisitions, organic growth, and the active management of multi-family rental properties with significant upside potential. Our current geographical focus is in Alberta and British Columbia with diversified and growing economies, and strong population in-migration. Our business objectives are to achieve growing Net Operating Income (“NOI”) as well as the asset values in our multi-family rental property portfolio in strategic markets across Western Canada.

The management team at Yorkton Equity Group Inc. has well over 30 years of prior real estate experience in acquiring and managing rental assets.

Further information about Yorkton is available on the Company’s website at www.yorktonequitygroup.com and the SEDAR+ website at www.sedarplus.ca.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information on Yorkton, please contact:

Ben Lui, CEO – Corporate Office: (780) 409-8228

Yorkton Equity Group Inc. – Shareholder Communications: (780) 907-5263

Email: investors@yorktonequitygroup.com

Forward-looking information

This press release may include forward-looking information within the meaning of Canadian securities legislation concerning the business of Yorkton. Forward-looking information is based on certain key expectations and assumptions made by the management of Yorkton. Although Yorkton believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Yorkton can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. Yorkton disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in the United States. The securities described herein have not been and will not be registered under the United States Securities Act of 1933, as amended, or any applicable securities laws or any state of the United States and may not be offered or sold in the United States or to the account or benefit of a person in the United States absent an exemption from the registration requirement.